Fixed Time mode

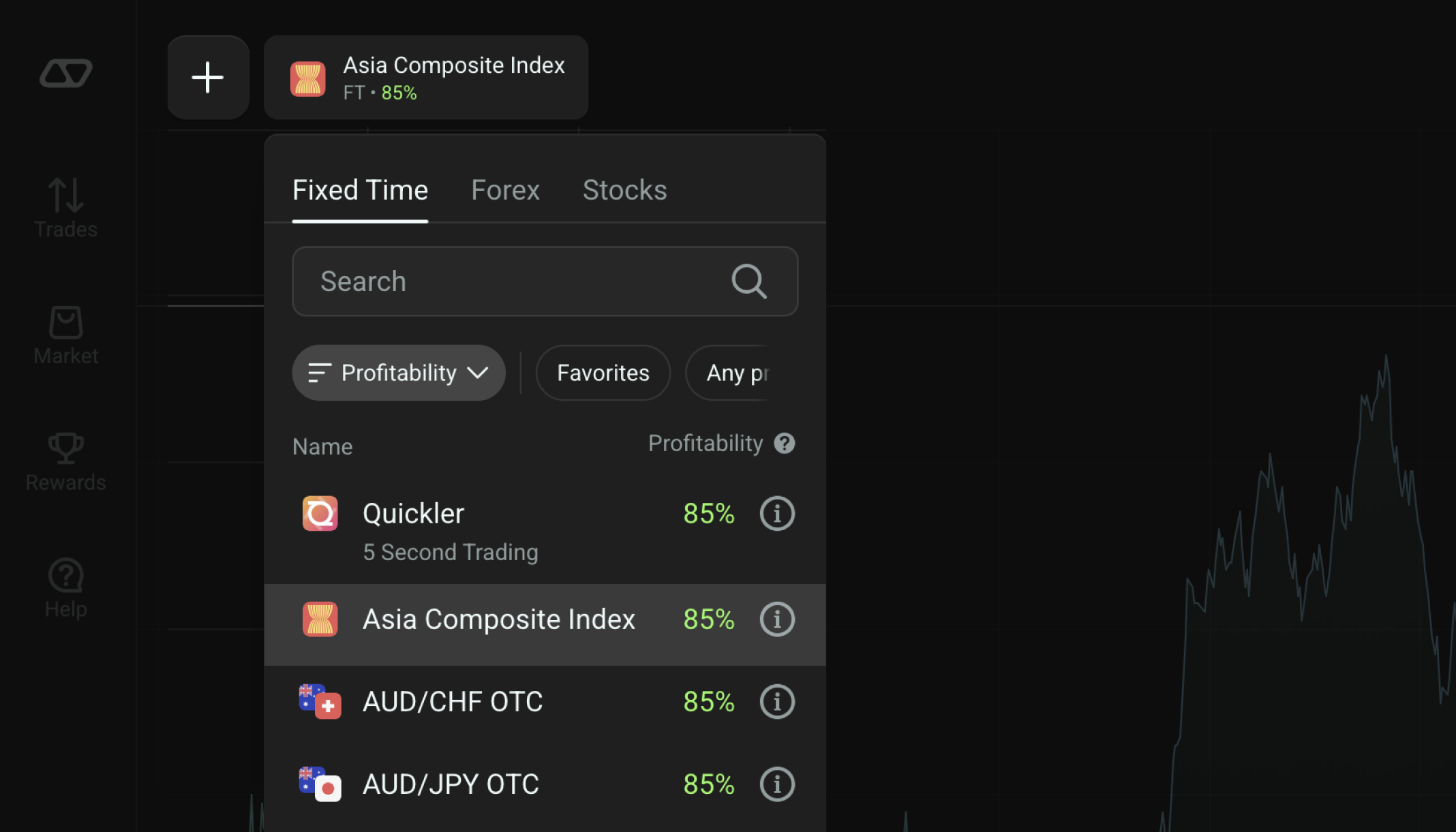

Fixed-time trades (FTT) are short-term trades with a fixed duration, typically from 1 to 60 minutes. To get to this mode, click on an asset’s name at the top of the chart. Tap on the Fixed Time tab and pick a trading asset.

You need to predict whether the price of an asset will go up or down during a specific time, and then invest money in your trade.

If your forecast is correct, you’ll earn money. The potential profitability is shown in advance — you can see this percentage listed near the name of the asset. For example, in the screenshot above, the profitability of trading GBP/USD is 82%. That means you’ll earn $8.2 if you invest $10. You’ll have this gain regardless of which trade duration you choose — whether it’s one minute or one hour.

If your forecast doesn’t turn out correct, you will lose the amount invested in the trade. In this case, $10.

How to open an FTT trade

1. Pick a trading asset and make your forecast about its price. To do that, you can use the chart analysis tools and trading strategies that we’ll explain later in this course.

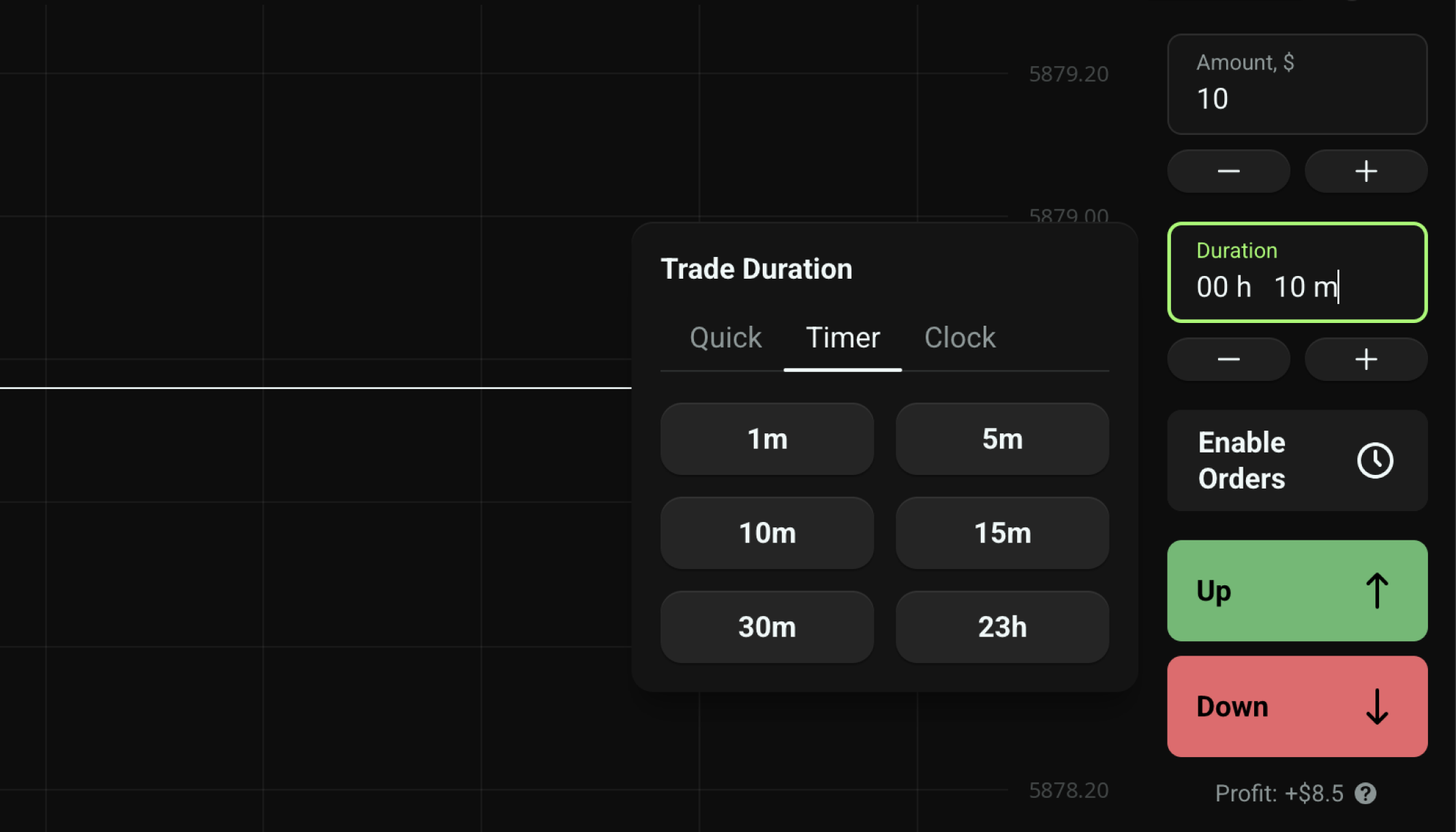

2. In the trading panel, choose the trade amount. Remember the tips about trade amount and money management from the previous lesson.

3. The timeframe of your forecast is referred to as duration.

4. Click Up or Down, depending on your forecast.

The trade will automatically close once the trade’s duration has been reached, and the resulting profit or loss will be registered on your account. You can also close a trade earlier, though in this case, you could lose part of the amount you spent on this trade.

When to trade in FTT mode

Many traders start with FTT mode because it’s easy to understand. You don’t need to forecast how far up or down the price goes, you just need to predict the direction and set a trade duration. Bear in mind, though: Making a correct forecast like this is not always easy. When you operate on very short-term timeframes, such as 1 to 15 minutes, the price can make unexpected moves called “market noise.” As a result, you’ll need to adapt to market fluctuations (although with FTT, you won’t need to wait long to see the outcome of your trades).

Here are the general recommendations for FTT trading:

1. Find active trends. This way, it will be much easier to forecast where the price will be when the trade order expires. Even if the price is slightly higher than the opening price, you will get a fixed rate of return in the case of an Up trade.

2. Start with a small test trade to confirm the trend’s viability. If it works, make more trades in the same direction with every win.

3. Stay alert for price reversals, and wait patiently for the next wave of the trend.

4. Keep your trade amount small relative to your deposit, even if you are tempted to increase the trade amount.

5. Keep track of your wins and mistakes to learn from your experiences.

Next

In the next lesson, you’ll learn how Forex mode differs from FTT and in which cases traders use it.