What is a trading strategy

You will achieve more in trading if you have a plan — that is, a strategy.

A trading strategy is a set of rules defining when and how you open trades. You can view it as a checklist: if you can tick all the boxes, go ahead and open a trade. A strategy helps to approach the market logically and reduce bad trade entries. As a result, a strategy increases the probability of making a smart decision.

There are many different strategies, but they all have common elements: conditions for opening or closing a trade, and risk management.

Elements of a trading strategy

There are several crucial elements of a trading strategy:

1. Asset selection

You first need to decide which asset you are going to trade. Olymptrade offers various trading assets such as currency pairs, commodities, stocks, indices and crypto. These assets may have different levels of volatility and require different strategies.

For example, AUD/USD and GBP/JPY tend to move in trends more than other currency pairs.

2. Market phase

Estimate the phase that the asset’s price is in. Is there a trend, or a range? Will you trade in the direction of a trend or on a correction? The logic of the strategy will be different for each case.

For example, when there’s a range, traders will seek opening Up trades at the bottom of the range and Down trades at the top of the range. If there’s a trend, trend traders will focus only on catching the price action in the direction of this trend.

3. Position sizing

Position sizing is an important risk management aspect of your strategy. It determines how much of your capital you’re willing to risk in a single trade. A common rule is not to risk more than 1% to 2% of your trading account balance in a single trade.

For example: If your trading account balance is $1,000 and you decide to risk 1% per trade, that means you’re willing to lose up to $10 on a single trade.

4. Entry points

Your strategy needs to specify the conditions under which you enter a trade. These can be based on price action, technical indicators or fundamental analysis.

For example, the Average Intersection strategy uses three indicators: an SMA with a period of 4, an SMA with a period of 60, and Parabolic. The signal to open an Up trade is when the SMA with a period of 4 crosses the SMA with a period of 60 from below, and the Parabolic dots are below the candlesticks.

5. Exit points

Equally important, your strategy needs to specify when you’ll exit a trade, either to take profits or cut losses.

For example, in the Average Intersection strategy mentioned earlier, the rule to close the trade is when the Parabolic dots move above the candlesticks.

6. Risk management

Risk management rules are crucial for protecting your trading capital. These rules can include setting Stop Loss and Take Profit levels as well as adjusting position size according to your risk tolerance.

Continuing with our example, you might set a Stop Loss at a certain price below your entry point, which limits your losses if the trade goes against you.

7. Strategy testing

You can test your strategy on historical price data to see how it would have performed, or you can check the strategy in real time on a demo account. This way, you can prove your strategy is working before you start live trading.

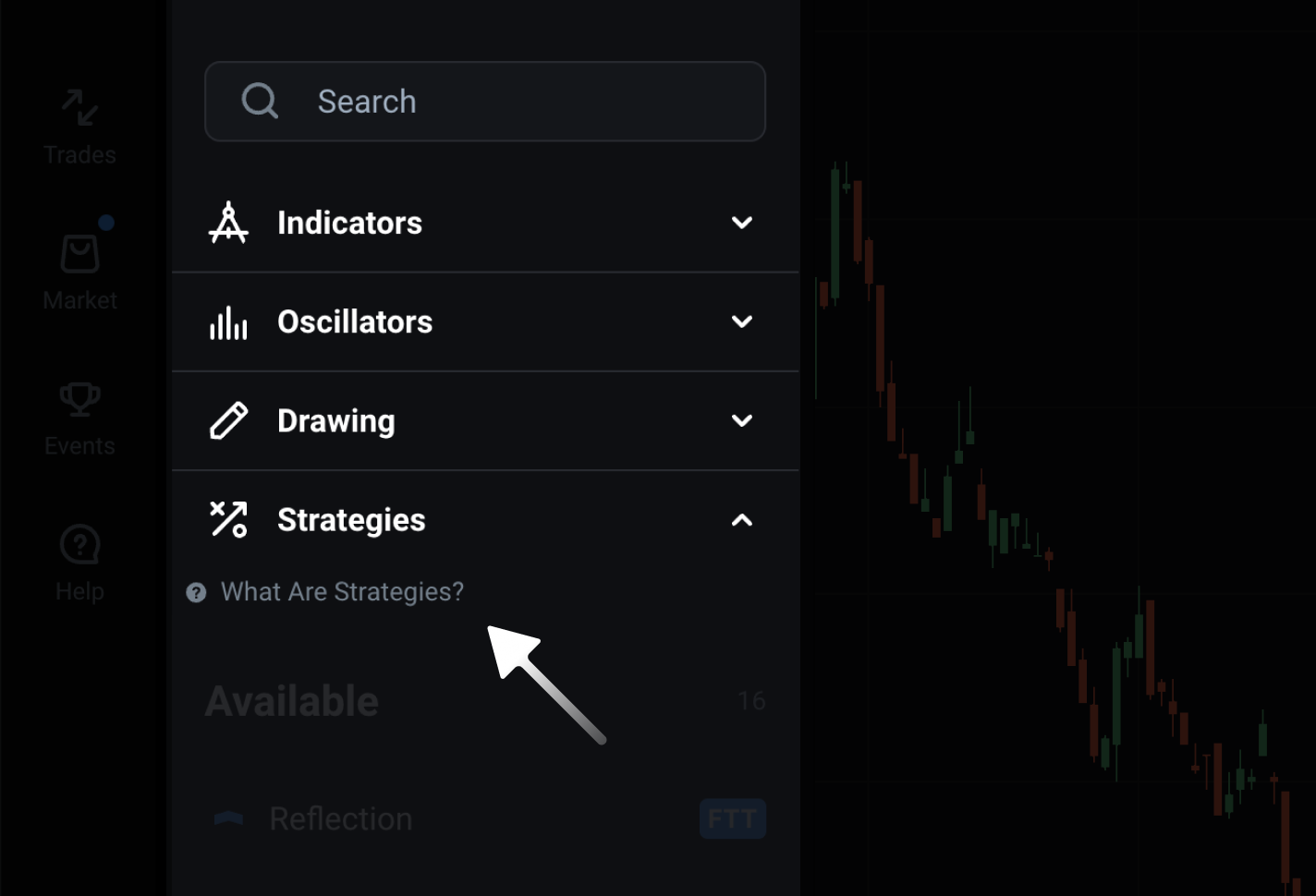

Olymptrade offers many pre-programmed trading strategies. Click the Technical Analysis icon on the price chart and check the available strategies in the instruments list. You can also find strategies in the Market tab. After you have applied a pre-programmed strategy, the indicators it contains will appear on the chart. Check the description of the strategy to learn how to use it.

Next

In the next lesson, you’ll learn about the most common trading strategies applied by Olymptrade users.